by Bruce Dunlavy (My blog home page and index of other posts may be found here.)

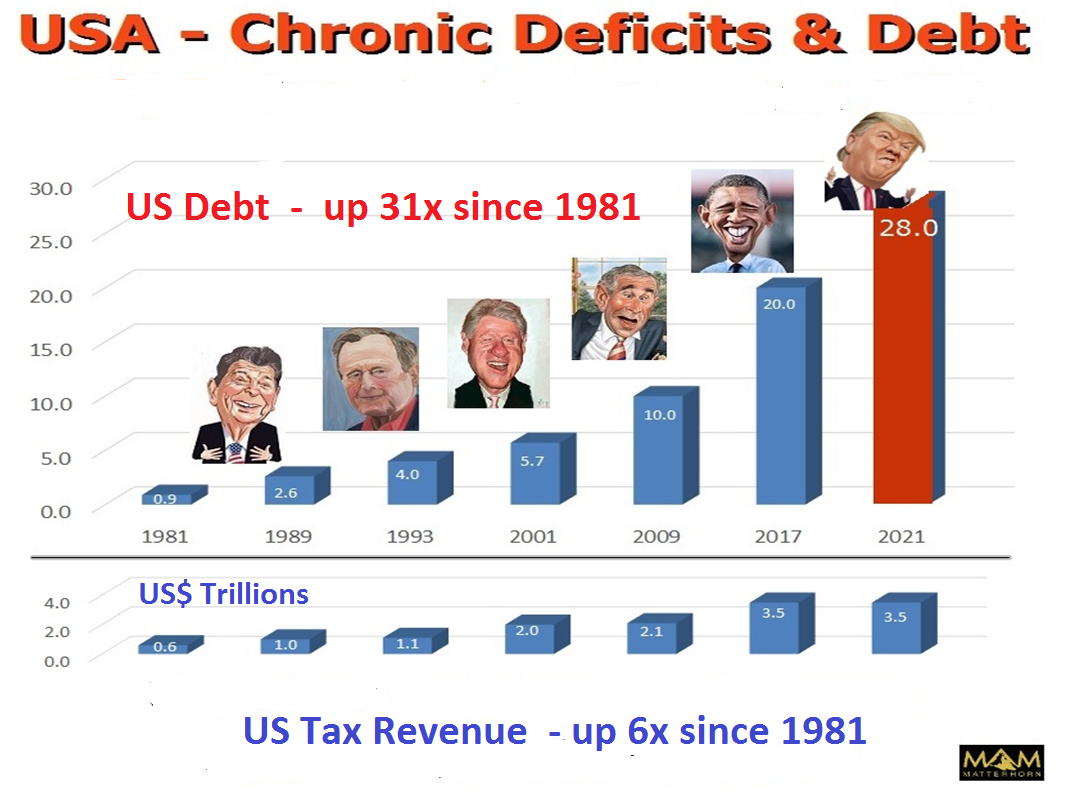

There is scarcely a political or economic discussion in America – in the bowling alley, the coffee shop, the university lecture hall, or the Congress – that does not eventually get around to the National Debt. All 18 trillion dollars of it. [Update: As of early 2023, it’s over 31 trillion dollars.]

Questions swirl around The Debt:

• How can a nation survive with a debt that huge?

• Why doesn’t the government live within its means?

• If my family has to balance its budget, why doesn’t the United States have to?

• What will happen when the Chinese demand repayment of all they’ve lent us?

• Will (or when will) the USA go bankrupt?

Often, the words “National Debt” are followed by the word “crisis.” The Debt is always critical. Whether it’s how big The Debt is, how fast it’s growing, or who’s to blame for it, at the heart of it all is a complaint. No one talks about the National Debt being useful or in any way desirable. It’s always portrayed as just another example of irresponsible government.

In order to get a sense of how much money The Debt represents, think of a stack of crisp new one-dollar bills. A million dollar bills will make a stack about two feet high. A stack of a billion dollar bills would be taller than One World Trade Center. By the time you got a stack of a trillion one-dollar bills, the pile would be getting close to 380 miles high. That means the National Debt itself would be nearly a 7000-mile stack of bills.

How scary is that? To most Americans, many of whom are worried about their own indebtedness with a $150,000 mortgage and the monthly payment on a $20,000 car loan, it’s terrifying. No wonder they experience a great deal of anxiety about what will happen if and when China calls in its loans.

So let us have a look at the origin of the National Debt and whether it serves a purpose. The National Debt began when the United States of America began. It took a lot of money to fight the Revolutionary War, and most of that had to be borrowed. When the Constitution was being written and approved, Alexander Hamilton (who would become the first Secretary of the Treasury) fought to include the first section of Article VI, ensuring that these debts and any others contracted under the Articles of Confederation would be honored under the Constitution. (There is a very good book, understandable to the non-economist, White House Burning, by Simon Johnson and James Kwak, that explores this issue in depth.)

Hamilton’s reasoning was this: being able to float a debt and make regular payments to retire it would underscore the legitimacy of the nation and demonstrate its creditworthiness should future borrowing be necessary (such as for a future war). In addition, those who were owed money by the United States would have a vested interest in its success.

Let’s stop and consider that. What if China suddenly demanded payment on all those USA bonds they hold? Wouldn’t that bankrupt the United States government? The short answer is no, and not just because bonds have years-long repayment schedules that cannot be unilaterally dismissed by the bondholder.

First of all, the USA has a fiat currency, which is to say that the nation issues its own money by order, not backed by (or limited by a supply of) any physical commodity such as gold. The country can print as much of it as it thinks is appropriate. The nation’s bonds are payable in dollars, so the idea that all our debts coming due at once would mean the nation’s running out of money is incorrect. We could print as many dollars as it would take to pay off the bonds.

Of course, increasing the money supply is the very definition of inflation, so the value of each dollar would nosedive. But the nation would not run out of them. The more appropriate question is why those who hold USA bonds would want to devalue the currency those bonds are backed by. And why would they want to bankrupt the nation that owes them all that money, even if they could?

There is an old saying, “If you owe the bank fifty thousand dollars, you have a problem. If you owe the bank fifty million dollars, the bank has a problem.” Should you default on that much money, the bank will take a real hit. If the USA defaulted on its bonds, China would take a real hit. So China definitely has a vested interest in seeing the American economy prosper. After all, a bond represents an investment, a stake in the success of the enterprise backing that bond.

It would probably surprise most Americans to know that China and all other foreign governments hold only about 30 percent of USA debt. As of this writing (April 2015), China and Japan top the list of creditors at about 1.25 trillion dollars each; many other countries own smaller amounts totaling about six trillion. So what about the rest? To whom does the country owe the other 70 percent of that 18 trillion? The answer is: mainly, to ourselves.

Image credit: goldbroker.com

Almost a third of The Debt is owed by the government to itself – one agency borrowing from another. For example, the Social Security Trust Fund is lent to a couple of hundred other governmental units. Why lend out the Social Security account? Why isn’t it safely locked away untouched? Because that would be rather like stuffing your life savings into a coffee can and burying it in your back yard instead of investing it or putting it into a bank account so it will increase in value.

Even individuals own some of the National Debt. If you buy a U.S. Savings Bond, you become a creditor of the USA. If you own mutual funds or are vested in a pension plan, you own part of The Debt that way, too, since these entities also buy government bonds.

Constitutionally, the debt is backed by the “full faith and credit of the United States,” as well as by the nation’s assets. There is some gold in Fort Knox, of course, although not nearly enough to redeem every dollar in print.

But why doesn’t the government have to balance its budget? Doesn’t each family have to balance its budget every year? That depends on what you mean by a “balanced budget.” If you mean that expenditures are never more than income, then the answer is no. If your family bought a house, unless you paid cash for it you took out a mortgage loan. You spent more than you earned. The same goes for an auto loan, a credit card balance, or any other type of loan. Debt is used by households to leverage the purchase of things they consider worth acquiring that they don’t have the cash for.

The government does the same thing. And just as a home mortgage or car loan is backed by the value of the property used as collateral, the assets of the United States – in the form of bullion, land, buildings, military hardware, and so forth – back the loans taken out by selling bonds. Right now, money is incredibly cheap, too. Just as a family wants to borrow money for a mortgage or a car loan when interest rates are low, the best time for the government to borrow money is also when it’s cheap.

In fact, interest rates on government bonds are so low right now that borrowing money is practically free. During the financial crisis of 2007-2008, some government bonds were being resold on the secondary market at interest rates below zero – returning negative interest. Buyers were so eager to invest their money in something as secure as the USA that they were willing to incur a little loss in doing so. The Federal government sold bonds with a negative yield directly through auctions in 2010.

How much debt should a family have? Credit being much more available today than 50 years or more in the past, a typical family may have a debt of 100% of their annual income. For some comparability, the National Debt is often measured against the Gross Domestic Product, which is a sort of equivalent of income, but on a national scale. Right now, The Debt is at about 105 to 110 percent of GDP, a level most economists consider prudent.

So I think we can safely say that the National Debt of the USA is not a bad thing, per se, and can be a valuable tool in structuring responses to changing economic conditions. In fact, the country might be worse off if everybody stopped funding our debt by buying our bonds.

We can also feel comfortable that the country is not currently going bankrupt, nor do the foreign nations which hold a third of our National Debt want us to do anything except remain economically robust enough to be able to pay them back. Finally, the amount of our current debt is reasonable and defensible, given the economic circumstances of 2015.

Is the United States National Debt an existential danger to the nation? Probably not. It’s just a way to accomplish things using other people’s (and other nations’) money.